Here’s the sample Appraiser Fee Disclosure. (Click the image.)

Category: Appraisal

Appraisals for Trusts, Estates and Probate

Though much of my business comes from lenders and banks, I do a fair amount of valuation work for attorneys, CPA’s, trustees, executors, and estate planners. This often involves appraisals of real property related to setting up and administering Trusts, Estate planning, and settlement at the time of death or property tax assessments during the course of Probate.

Trusts and Working with Trustees

A trustee is usually an individual who acts as the administrator for property or assets for the benefit of a third party. A trustee can be chosen for various purposes and are entrusted to act in the best interest of the trust’s beneficiaries.

When a trust is set up, assets are put into a trust and sometimes those assets are real property (primary residence, rental properties, vacation homes, etc.). Before these assets are placed into the trust it is required that a value be established for the properties in order to establish the overall value of the trust. This situation is just one example in which a trustee would order an appraisal for all real property being placed into the trust. It is often a crucial step because various types of trusts have differing rules concerning disbursements from the trust based on the overall value of the trust. Without establishing value for the assets in the trust, the trustee could not calculate appropriate disbursements to the beneficiaries.

Because of the nature of trusts, appraisals may not be needed at the time of the original grantor’s death, but it may be prudent to get a valuation for the property at that time in order to establish current value to limit potential future capital gains if the beneficiaries are allowed (through the structure of the trust) to sell the property in the future. It is a complex situation and should be discussed in depth with a tax attorney, CPA, or both.

Estate Planning and Settlement

An estate planner is often an attorney who helps manage the asset base with an eye to the future in terms of minimizing tax liability and ensuring a distribution of assets to heirs at the time of death. Estate planning can be an ongoing process as additional assets are added to the estate or existing asses’ values fluctuate. If these assets are real property, the estate planner will often order a real estate appraisal to establish the value of the property, since it will be included in the overall value of the estate.

Additionally, at the time of death the executor of the estate may need to order a new real estate appraisal to establish current market value for all real property, for both tax and distribution purposes. Estate taxes can be a concern, so a CPA or tax professional should be consulted. It is likely that the executor will order an appraisal on all real property at the time of death, in order to establish the estate’s value and the subsequent distribution of funds.

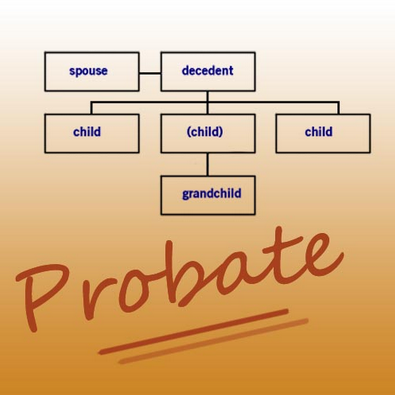

Probate

Unfortunately, not everyone plans for their death and quite often property falls into probate even if a legal will has been executed. Probate can be defined as “…the general administering of a deceased person’s will or the estate of a deceased person without a will. The court appoints either an executor named in the will (or an administrator if there is no will) to administer the process of collecting the assets of the deceased person, paying any liabilities remaining on the person’s estate and finally distributing the assets of the estate to beneficiaries named in the will or determined as such by the executor.” (Investopedia)

The assigned executor will likely order an appraisal to establish the value of any real property assets. The valuation is going to be key in settling any current or past due property taxes and ensuring that the overall estate in under certain tax thresholds. State’s rules vary inheritance taxes.

Procedures related to trusts, estates and probate can be complex and stressful for all of the parties involved. Establishing the value of real property is often a necessary step by engaging a qualified real estate appraiser.

Q & A with Josh Walitt on Residential Appraisals Colorado

Question #1:

Question #1:

My bank said they ordered an appraisal for my loan, but no one ever came inside the house. Does this sound right to you?

For certain types of loans, such as home equity loans, banks follow specific federal guidelines (called Interagency Guidelines) which allow for the bank to use an exterior-only appraisal from a licensed or certified appraiser in some cases. These types of exterior appraisals are typically used in low-risk lending situations, and can also used by banks for pre-foreclosure, loss-mitigation, and similar situations. Since the property is only observed from the street, the homeowner may not even know that the appraiser’s visit took place.

With exterior-only appraisals (sometimes referred to as “drive-bys”), assumptions are made about the interior, sides (if not visible from the street), and rear of the property, as well as the site in general, based on the limited viewing of the property, along with public records, any records in the local real estate MLS system, aerial imagery, or file information the appraiser has on the property, as long as the sources are determined to be reliable. For example, the appraiser may see that the visible parts of the property are in average condition displaying little-to-no needed repairs, so he could assume that the entire property is of similar condition. Or, based on the county records, the appraiser could assume the subject has a covered back patio, a fireplace, and a detached utility building, none of which is visible from the street. Keep in mind, these exterior-only appraisals are not typically ordered for first-mortgage loans, such as when you buy a house.

For first mortgages, a full appraisal is usually conducted, which includes the appraiser viewing the inside and outside of the property. In these situations, the inventory of the property is observed by the appraiser (rather than making assumptions, as in exterior reports). However, it is important to remember that the appraiser is not a home inspector, so he will still make certain assumptions. For example, the appraiser may assume the utilities are functional, the structure is sound, there are no health hazards, and so on, as long as there is no evidence to the contrary.

There are some situations where the bank can loan without the use of an appraisal. If there is ever any question, remember this: a borrower can ask to review copies of all valuation reports that the lender used.

Question #2:

I got my own appraisal a few months ago because I was thinking of listing my house for sale. Now I want to refinance, but my banker won’t take that appraisal.

There are several factors at work here.

First, banks are required to order their own appraisals, ensuring certain Appraiser Independence regulations are met. For a privately ordered appraisal, such as for a legal matter, a trust, an estate following a death, or a pre-listing appraisal, these regulatory safeguards are most likely not met. Banks and lenders have internal departments and staff that carry out and monitor the appraisal-ordering procedures, although some choose to use third parties.

Second, an appraisal has specified Intended Use and Intended Users. To follow federal rule, appraisers must identify the Use and Users of an appraisal report. Examples include: to determine a property’s market value to aid in listing it for sale by the homeowner and real estate agent, to determine market value for divorce purposes by Mr. Smith and his attorney, and so on. The Use and User for lending appraisals may often be to evaluate the property for mortgage purposes by the lender.

Why is this so important? The Use can impact what the appraiser is trying to solve: is it liquidation value, market value, a range of values, before- and after- remodel values, a future anticipated sale price? And the Intended User can be a very important factor in the level of detail and information that the appraiser provides in his report. For example, writing for a lender, the appraiser would not hesitate to use terms such as “bracketing”, “highest-and-best use”, “super-adequacy”, “regression analysis”, and so on; these terms could confuse many homeowners, agents, or attorneys, unless there was further explanation in the report. Consider that the appraisal written for you, a homeowner, may not have contained details about the availability of public utilities, a cost to fix flaking paint, a photo and description of the crawlspace, and so on; for some lending purposes, though, these items may be expected by the lender. In some cases, there are specific requirements for legal, tax, and estate appraisals that wouldn’t even be mentioned in other appraisal reports written for other clients.

There are a variety of reasons you might order a private appraisal, so be sure to discuss with the appraiser exactly what it will be used for.

This article was first published from The Daily Sentinel- GJ Real Estate Weekly.

Agencies Issue Proposed Rule on Minimum Requirements for Appraisal Management Companies

Six agencies released a Joint Release “Agencies Issue Proposed Rule on Minimum Requirements for Appraisal Management Companies”. The release, and its attached Proposed Rule, list five AMC requirements that participating States must enforce, as well as six broad powers the States must have related to monitoring, disciplining, and reporting.

The Joint Release also points out to States that participation is not mandatory; non-participation by a State would bar appraisal management companies from doing business in that State related to federally-related transactions.

Read the Joint Release and the Proposed Rule. The Proposed Rule contains instructions for comment.

———————————————————————————————————————-

WASHINGTON— Six agencies today issued a proposed rule that would implement minimum requirements for state registration and supervision of appraisal management companies (AMCs). An AMC is an entity that serves as an intermediary between appraisers and lenders and provides appraisal management services.

In accordance with section 1124 of Title XI of the Financial Institution Reform, Recovery, and Enforcement Act of 1989, as added by section 1473 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the minimum requirements in the proposed rule would apply to states that elect to establish an appraiser certifying and licensing agency with the authority to register and supervise AMCs.

The proposed rule would not compel a state to establish an AMC registration and supervision program, and there is no penalty imposed on a state that does not establish a regulatory structure for AMCs. However, an AMC is barred by section 1124 from providing appraisal management services for federally related transactions in a state that has not established such a regulatory structure.

Under the proposed rule, participating states would require that an AMC:

Register in the state and be subject to its supervision;

Use only state-certified or licensed appraisers for federally related transactions, such as real estate-related financial transactions overseen by a federal financial institution regulatory agency that require appraiser services;

Require that appraisals comply with the Uniform Standards of Professional Appraisal Practice;

Ensure selection of a competent and independent appraiser; and

Establish and comply with processes and controls reasonably designed to ensure that appraisals comply with the appraisal independence standards established under the Truth in Lending Act.

The proposed rule also would require that the certifying and licensing agency of a participating state have certain authorities, including the authority to:

Approve or deny initial AMC registration applications and applications for renewals;

Examine the AMC and require the AMC to submit relevant information to the state;

Verify that the appraisers on the AMC’s appraiser network or panel hold valid state certifications or licenses;

Conduct investigations of AMCs to assess potential violations of appraisal-related laws;

Discipline an AMC that violates appraisal-related laws; and

Report an AMC’s violation of appraisal-related laws, as well as disciplinary and enforcement actions, and other pertinent information about an AMC’s operations to the Appraisal Subcommittee of the Federal Financial Institutions Examination Council.

The proposed rule would provide participating states 36 months after its effective date to implement the minimum requirements. An AMC that is a subsidiary of a financial institution and regulated by a federal financial institution regulatory agency is required by section 1124 and the proposed rule to meet the same minimum requirements as other AMCs, although such an AMC is not required to register with a state.

In conjunction with the proposal, the Federal Deposit Insurance Corporation is proposing to rescind appraisal regulations promulgated by the former Office of Thrift Supervision (OTS). The OTS appraisal regulations are duplicative of the FDIC’s appraisal regulations in Part 323. Similarly, in a separate rulemaking, the Office of the Comptroller of the Currency is rescinding appraisal regulations promulgated by the former OTS.

The proposal is being issued jointly by the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, the Federal Housing Finance Agency, and the National Credit Union Administration.

The Federal Register notice is attached. The agencies are seeking comments from the public on all aspects of the proposal. The public will have 60 days to review and comment on the proposal and the proposed Paperwork Reduction Act analysis. Publication of the proposal in the Federal Register is expected shortly.

Attachment: Minimum Requirements for Appraisal Management Companies – PDF

Media Contacts:

OCC Stephanie Collins (202) 649-6870

Federal Reserve Susan Stawick (202) 452-2955

FDIC Greg Hernandez (202) 898-6984

CFPB Sam Gilford (202) 435-7673

FHFA Corinne Russell (202) 649-3032

NCUA Ben Hardaway (703) 518-6333

PR-21-2014

This article was first published at FDIC.org

Key Parts of Residential Appraisal Reports Colorado

Not too long ago I was at a school event for my youngest daughter when I started talking to one of the fathers that I knew. During our conversation he mentioned that they were going through the process of refinancing their home and had just received the appraisal back. He shared a little sheepishly that he couldn’t make heads or tails out of it and wondered why the darn thing was so confusing. It reminded me that for someone who doesn’t look at these reports day in and day out they can be a little difficult to understand.

Residential appraisal reports can be quite complex; crammed full with comprehensive market information and different methods for estimating and analyzing value. Sometimes it can be cumbersome to try to sift through all of the information when the average homeowner just wants to get to the bottom line: How much is my home worth?

While the appraisal for a refinance or purchase is used by (and written for) the lender, the document is oftentimes read by the buyers, sellers, and real estate agents. Appraisals are generally performed using similar approaches, regardless of the kind of residential property or which party employs the appraiser (such as for agents or homeowners, for pre-listing appraisals). Appraisers operate in locations they recognize. This provides functioning expertise of any local factors that might influence the value of a property.

The report will include specific attributes of the property and of the surrounding neighborhood. The report will note any damage or recent improvements to the home. There will be maps of the subject property location, as well as the comparable properties’ locations. A perimeter house sketch and pictures of the property are typically included. There will also be pictures of houses that have recently sold in the neighborhood. These are the comparables or “comps”. These recent sales are used to help establish value by analyzing recent sales of similar houses.

A typical appraisal, whether written on a Fannie Mae form for lending or a general purpose form for legal, pre-listing, or other uses, will include the following information:

The Subject: The subject area contains a description of the property including physical street address, legal description, county parcel number, and other identifying information.

The Contract: For a purchase, a summary of the signed purchase contract is provided. Federal regulations require that the lender provide a copy of the contract to the appraiser.

Neighborhood: This section describes characteristics, boundaries, and market conditions of the area and notes the one-unit housing trends. A reader will find information related to increasing, stable, or declining values. In many appraisals, there will also be attachments with further analysis of the market.

Site: The site section of the report covers the physical dimensions of the lot, zoning, nature of the utilities, and flood zone.

Improvements: Sometimes people misunderstand the word “improvements” – it basically means the structure or structures on the property. The lot was improved by putting a house upon it. So the type of house, description, year built, condition, quality, features, square footage, and other characteristics will be detailed in this section.

Sales Comparison Approach: This approach to value is commonly given the most weight in the valuation for residential properties. Here is where I will grid and analyze recent sales of comparable properties in the neighborhood and then make adjustments to the property being appraised. For example, if a comp is bigger than the subject, a negative adjustment may be made; if it is inferior in condition, a positive adjustment may be made. These positive and negative value adjustments are made considering a variety of comparable factors like age, condition, square footage, baths, lot size, and other characteristics that impact marketability and value.

Reconciliation: The sales comparison approach, the cost approach, and/or the income approach (if developed) are reconciled into a final value. If those other two approaches are not used, the final value opinion is established using only the sales comparison approach.

Of course, these are just a few of the key areas of an appraisal report. I always remind people that the appraisal report is an essential document – whatever its intended use is – and a user of the report really needs to take the time to read it, ask questions, and confidently understand it.